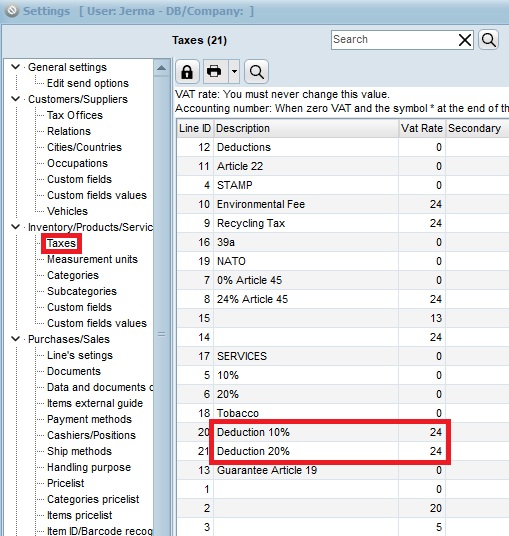

Initially, separate 24% VAT entries should be created for each deduction rate.

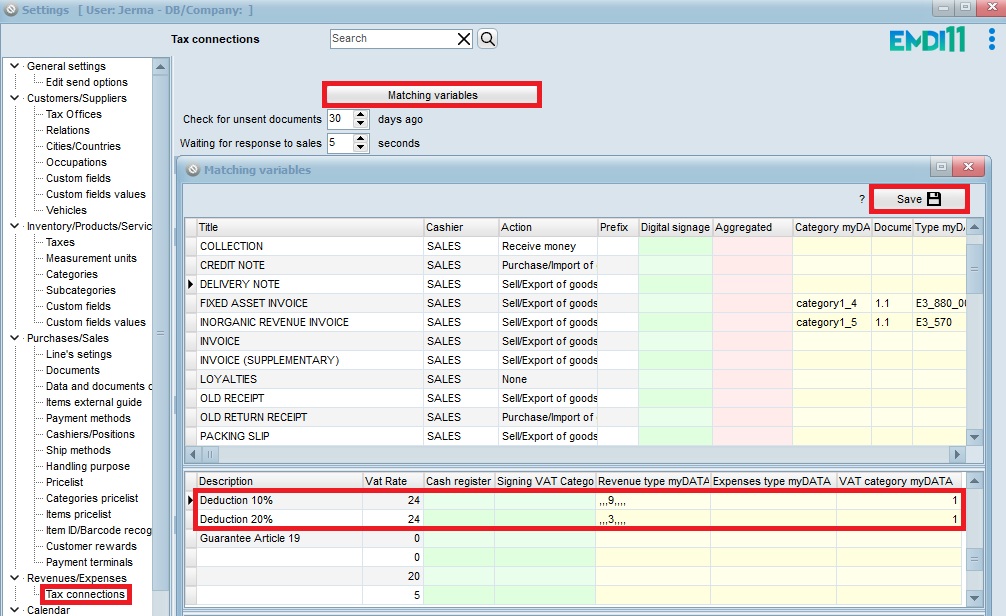

Then in Tax connections, the Matching variables‘ settings will be set as shown below.

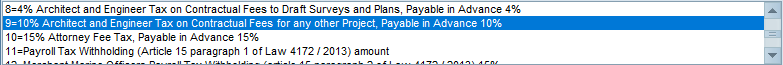

Specifically in the Revenue type myDATA the Withholding taxes should be 9 and 3 for the deduction of 10% and 20% respectively.

Finally, each deduction will operate as in the relevant article, with the difference that one of the above 24% VAT will be applied instead of 0%.