There are two methods,

1st method: If we want to transfer the outflow tax as revenue.

Steps to transmit sales via distance through OSS

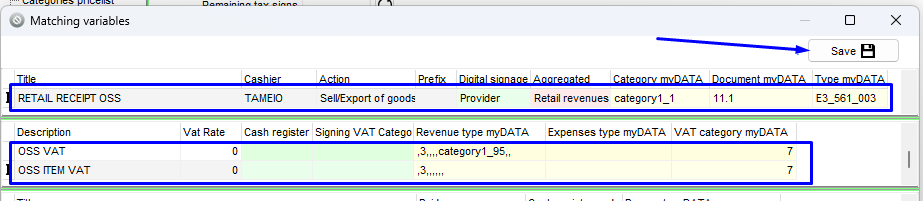

Characterization Info

For OSS Item VAT:

- Revenue Type myDATA:

- Exemption Category VAT: 3= Without VAT Article 13

- VAT Category myDATA:

- 7= Without VAT 0%

For OSS VAT:

- Revenue Type myDATA:

- Exemption Category VAT: 3= Without VAT Article 13

- Revenue Characterization Category Code: category 1_95= Other Income-related Information

- VAT Category myDATA:

- 7= Without VAT 0%

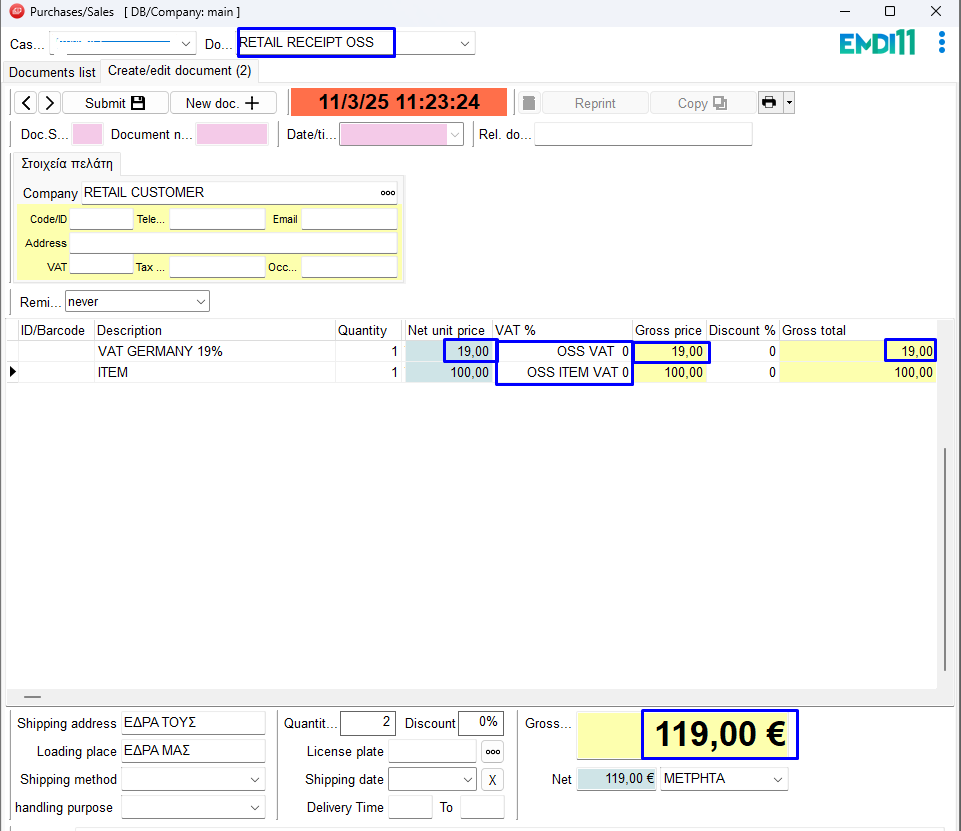

Basically we need to create two different lines in the document:

- One which will include the net value of the products with 0 VAT.

- One which will include the total VAT value that corresponds with the above.

In the second line the VAT value will be priced as a product with 0 VAT.

The above matching variables will be used as follows:

- ITEM VAT OSS: the VAT which we will use in the first receipt for the total gross value.

- VAT OSS: the VAT which we will use in the second receipt where we price the total VAT value of the first document.

Basically we price the VAT value as an additional item.

*In which case it’s not necessary to create a new document (Receipt OSS), it has the same matching variables as the regular one.

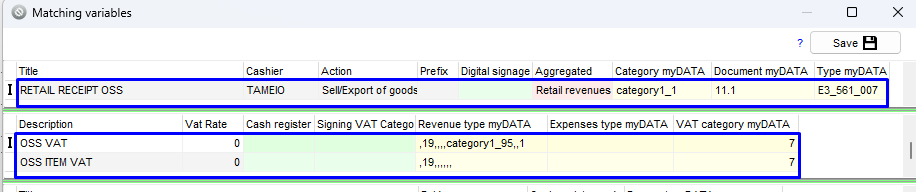

2nd method: If we want to transfer it as tax.

For OSS VAT:

- Revenue Type myDATA:

- Exemption Category VAT: 19= Without VAT Article 47

- VAT Category myDATA:

- 7= Without VAT 0%

For OSS Item VAT:

- Revenue Type myDATA:

- Exemption Category VAT: 19= Without VAT Article 47

- Taxes totals: 1= Withheld taxes

- Revenue Characterization Category Code: category 1_95= Other Income-related Information

- VAT Category myDATA:

- 7= Without VAT 0%

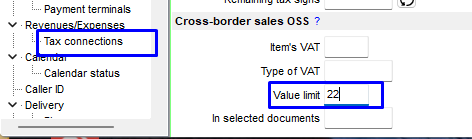

Also, in Tax connections (for both cases) go to the Cross-border Sales OSS settings and insert:

- Item’s VAT (Line ID of OSS VAT we created)

- Type of VAT (ID of the VAT item we created)

- Value limit (the IAPR instruction is from €22)

- In selected documents (select the receipt in which the OSS system will operate)

The retail receipt is issued as follows:

Basically the VAT will be treated as an additional item, which value will be the total VAT of this specific document.

The only difference is the matching variables we state as the withheld taxes.

Cross-border Sales OSS (One Stop Shop) only work for retail sales.