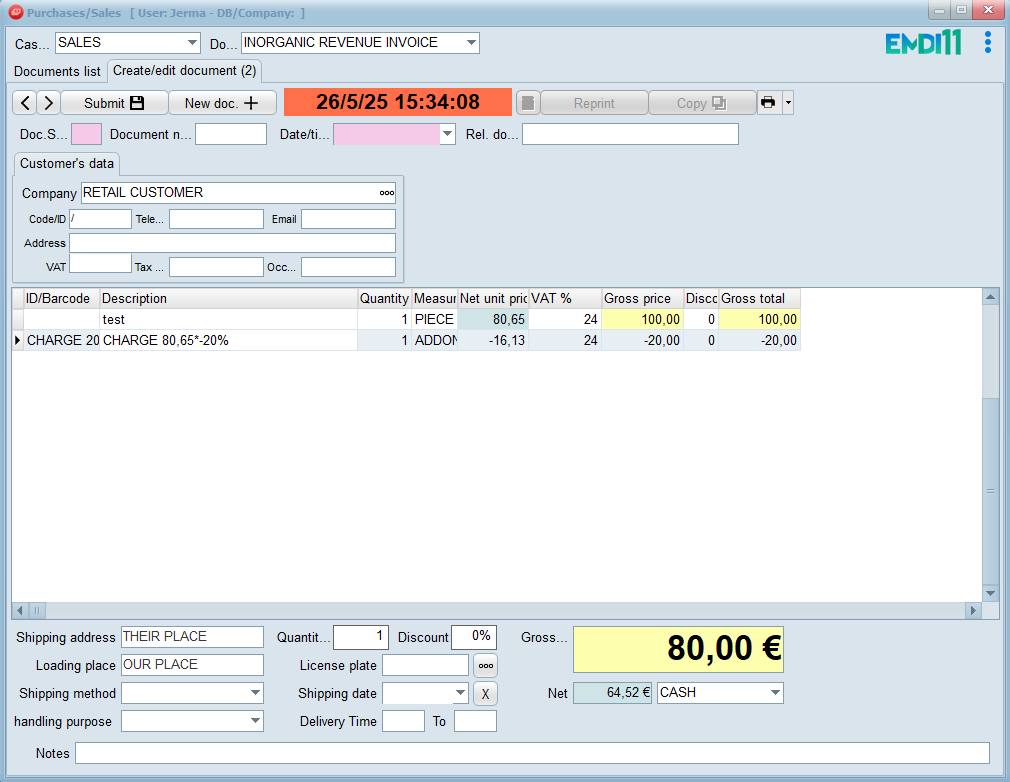

First of all, it should be noted that withholding taxes at EMDI, is considered any document line that is defined as an add-on with zero VAT and negative price.

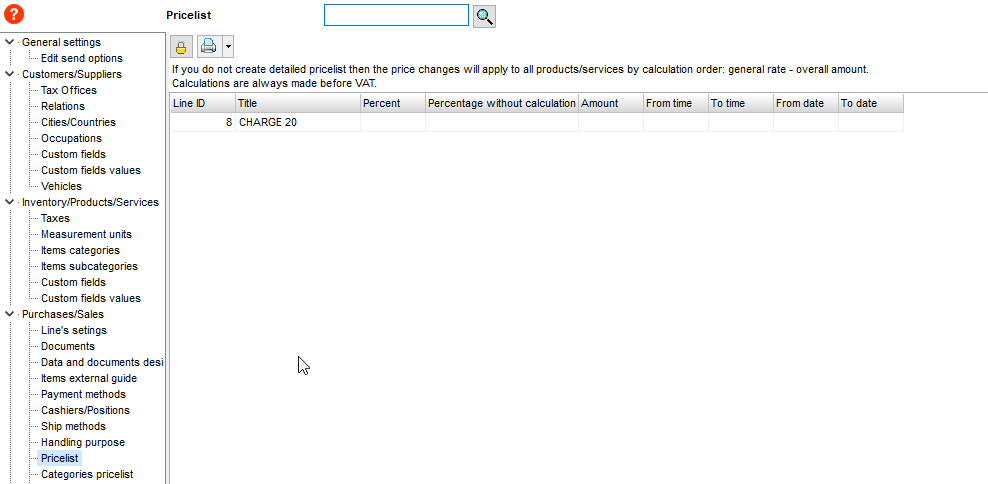

In order to make a deduction or charge I must first make a pricelist from the settings.

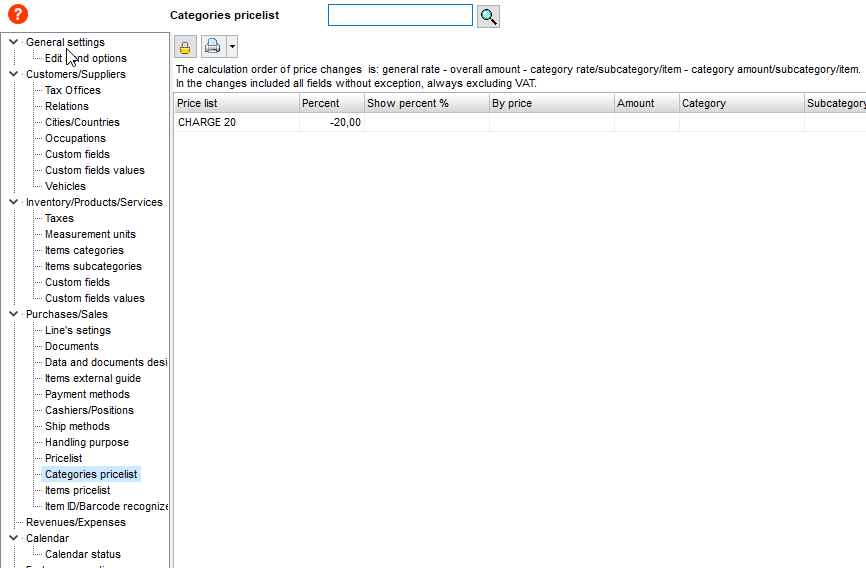

In this example I make a charge as a price list in the pricelist settings and then set the rate of the charge/deduction from the categories pricelist.

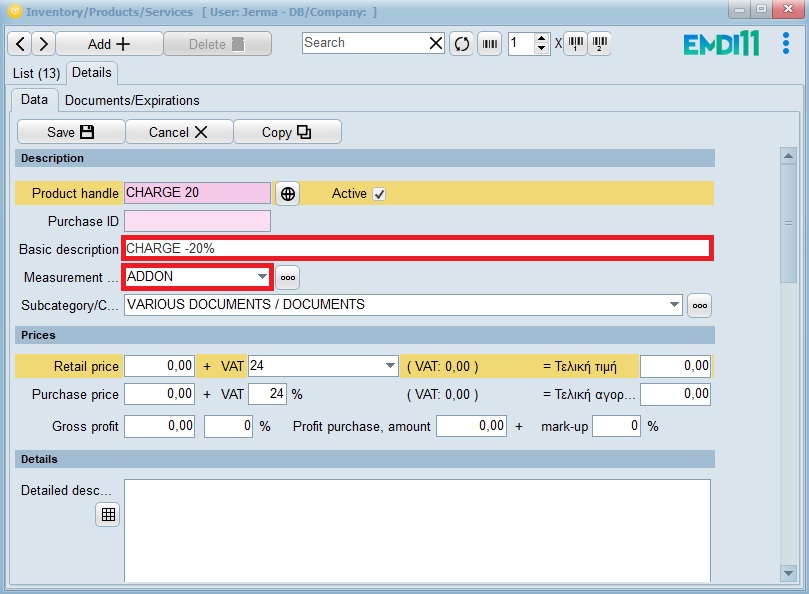

Then I have to make a product with a Product handle the name of the charge, add a description formatted as “-TEXT X%”, the measurement unit has to be addon and select a category.

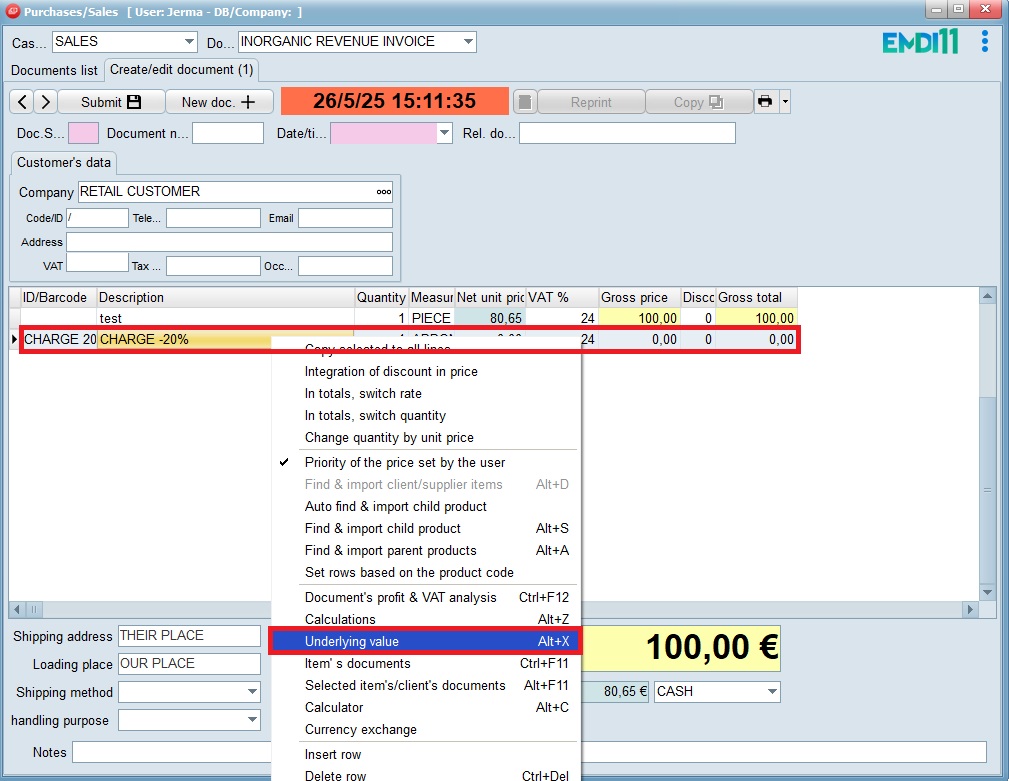

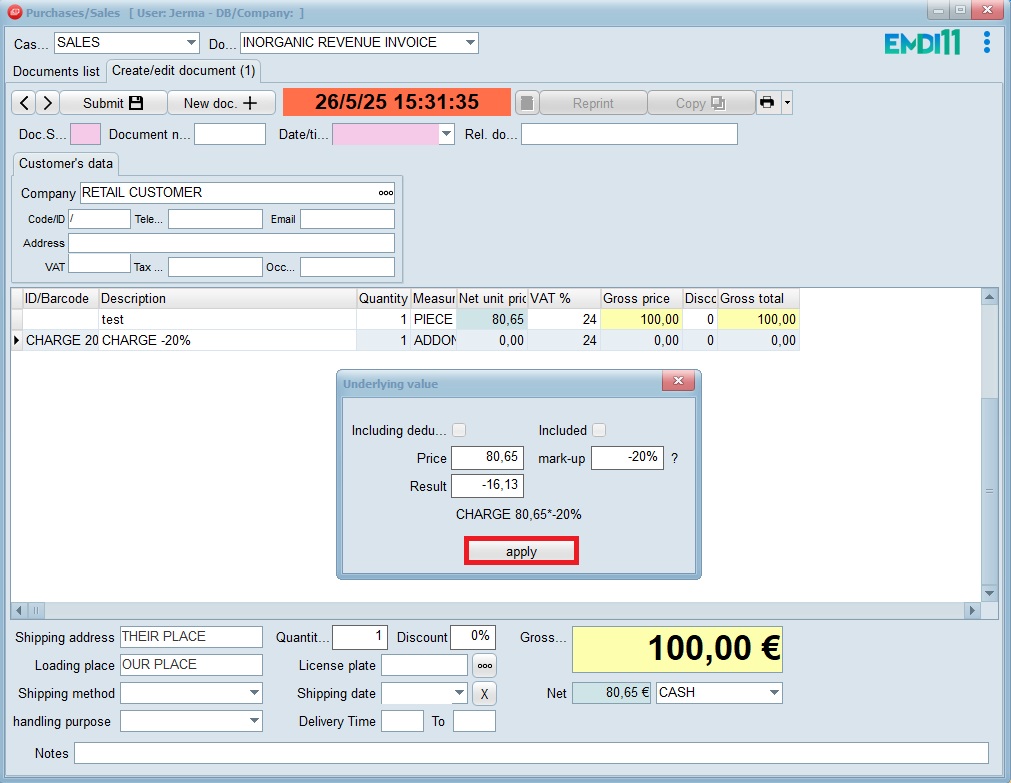

Next step is to go to Purchases / Sales and make a document with a product or service and place the charge in the line below. Then I right click inside document to open the menu and select Underlying value.

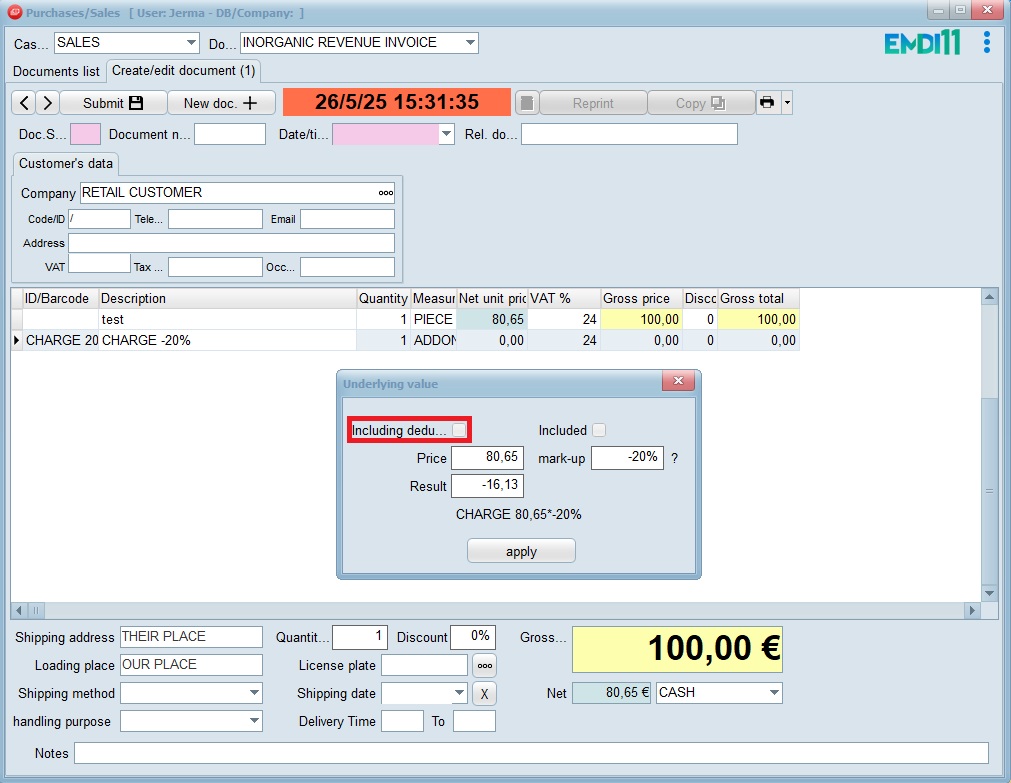

If I want to place a second charge and have it calculated, I check the “Including deductions checkbox”.

There is also the possibility of analyzing the charges in the printing using the variables #LOI, #LPF, #LPP. More information here.

Be careful not to use the symbols %. , # !)( in the VAT description